UK Salary Sacrifice Calculator

Estimate your tax savings and increased pension contributions

Enter Your Details

Speak to your HR team to see if salary sacrifice is right for you.

What is a Salary Sacrifice Calculator?

A Salary Sacrifice Calculator is an easy-to-use tool designed to help you estimate how much you could save on tax and National Insurance by entering a salary sacrifice arrangement.

By inputting your current salary and the amount you’d like to sacrifice for benefits such as pension contributions, the calculator quickly shows how your take-home pay and pension pot would be affected.

It removes the guesswork and lets you make smarter financial decisions by providing a clear picture of the savings and benefits involved in a salary sacrifice scheme.

👉 Want to learn more about how salary sacrifice works specifically for pensions? Read our in-depth guide on Salary Sacrifice for Pensions.

How Salary Sacrifice Calculator Works?

The Salary Sacrifice Calculator works by adjusting your gross salary based on your chosen contribution amount and recalculating your:

- Income Tax

- National Insurance Contributions (NICs)

- Take-home pay

- Total pension contribution

When you enter your salary and the percentage or fixed amount you want to sacrifice, the calculator applies the current UK tax rules and National Insurance thresholds to give you an accurate view of your financial outcome — both pre- and post-sacrifice.

Some advanced calculators also show employer National Insurance savings and potential added contributions, making it a powerful planning tool for both employees and employers.

Benefits of Salary Sacrifice Calculator

Using a Salary Sacrifice Calculator gives you more than just numbers ,it helps you explore a range of salary sacrifice benefits and take control of your financial planning. Key benefits include:

- ✅ Tax Clarity: Understand exactly how much Income Tax and NI you’ll save.

- ✅ Pension Boost: See how small salary adjustments can significantly grow your pension pot over time.

- ✅ Informed Decisions: Instantly compare pre- and post-sacrifice pay to make smarter financial choices.

- ✅ Employer Insight: Some calculators show how much your employer saves — and whether those savings are passed on to your pension.

- ✅ No Financial Jargon: Simple visuals and clear figures make it easy for anyone to use — no accounting degree needed.

Step-by-Step Guide: How to Use the Salary Sacrifice Calculator

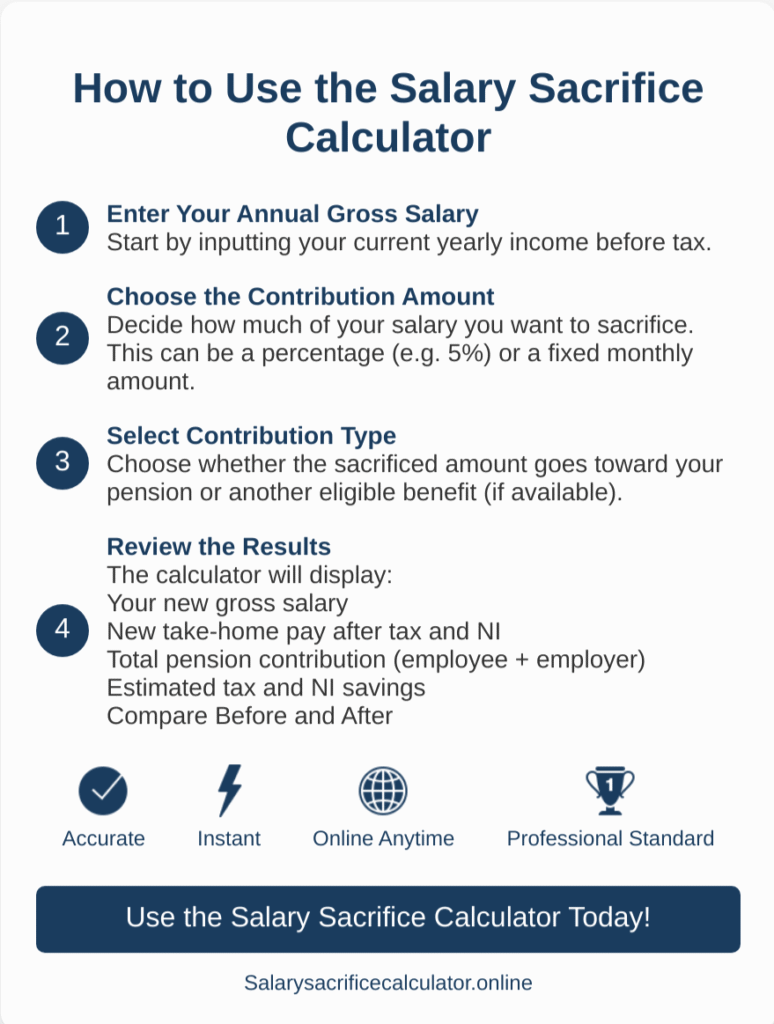

Here’s a simple guide to using a typical Salary Sacrifice Calculator effectively:

- Enter Your Annual Gross Salary

Start by inputting your current yearly income before tax. - Choose the Contribution Amount

Decide how much of your salary you want to sacrifice. This can be a percentage (e.g. 5%) or a fixed monthly amount. - Select Contribution Type

Choose whether the sacrificed amount goes toward your pension or another eligible benefit (if available). - Review the Results

The calculator will display:

- Your new gross salary

- New take-home pay after tax and NI

- Total pension contribution (employee + employer)

- Estimated tax and NI savings

- Your new gross salary

- Compare Before and After

Most tools let you compare financial outcomes side-by-side to help you visualise the benefit clearly. For a deeper understanding of how salary sacrifice stacks up against traditional arrangements, check out our guide on salary sacrifice vs net pay.

FAQs About Salary Sacrifice Calculator

Is the Salary Sacrifice Calculator accurate?

Yes, most calculators use the latest UK tax and NI rates, but it’s still a good idea to confirm with a financial advisor for personalised advice.

Does the calculator work for both basic and higher-rate taxpayers?

Absolutely. The calculator adjusts results based on your income level, so it works whether you’re a basic, higher, or additional rate taxpayer.

Can I use the calculator if I have a variable income?

Yes — enter an estimated average annual salary to get a useful approximation of savings.

Will this affect my other benefits?

Yes, potentially. Salary sacrifice can affect things like mortgage applications or statutory benefits. Use the calculator to see changes in your official salary and consult your HR or advisor if unsure.

Is my employer required to offer salary sacrifice?

No, it’s optional. You can use the calculator to see how beneficial it could be and then discuss it with your employer.